Tunde Adebayo: Career, Expertise, and Professional Impact in Regulatory Compliance

In the progressively intricate landscape of financial services, regulatory compliance has become one of the most crucial pillars of sustainable business practice. Among the professionals shaping the landscape of compliance and risk management is Tunde Adebayo, a well-regarded regulatory consultant with a strong background in financial crime prevention, compliance oversight, and regulatory advisory services. The name Tunde Adebayo is gaining recognition in the industry for his strong analytical approach, multidisciplinary expertise, and commitment to promoting ethical, transparent business operations. This article explores O’s professional profile, career journey, areas of expertise, and impact within the regulatory and financial services ecosystem.

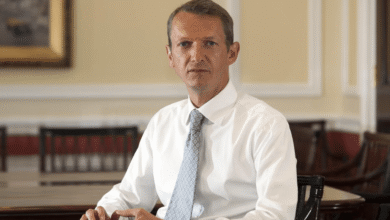

Who Is Tunde Adebayo?

Tunde Adebayo is a UK-based regulatory-compliance specialist known for his work with financial institutions, investment banks, and consulting firms. He currently serves as a Manager in the Regulatory Consulting practice at DWF Group, a leading legal and business-services provider with a global presence.

Adebayo is recognized for his depth of knowledge in financial regulation, firm grounding in financial crime risk management, and ability to translate complex regulatory requirements into practical, actionable business strategies. His reputation as a generalist across risk and compliance allows him to advise a diverse portfolio of clients on a broad range of regulatory matters.

Educational Background

One of the defining strengths behind the name Tunde Adebayo is his solid educational foundation. He holds:

- A Bachelor’s degree in Accounting and Finance equips him with a strong understanding of financial systems and business operations.

- A Master’s degree in Law and Finance, a unique combination that blends legal insight with financial expertise — an essential mix for navigating modern regulatory environments.

To complement his academic achievements, Adebayo has also earned professional certifications that demonstrate his commitment to staying aligned with industry standards, including:

- CISI Level 6 Diploma in Investment Compliance

- CFA UK Level 4 Investment Management Certificate

These qualifications position him as a seasoned specialist capable of advising financial institutions on regulatory expectations and best practices.

Career Journey and Industry Experience

Tunde Adebayo’s professional trajectory reflects consistent growth, adaptability, and valuable industry contributions.

Early Career in Financial Crime & Compliance

Before joining DWF Group, Adebayo worked at a financial crime consulting firm, where he advised clients in investment banking and asset management. His work involved:

- Conducting compliance assessments

- Supporting financial crime risk reviews

- Advising on regulatory controls

- Implementing remediation strategies

His experience in these early roles helped him develop a comprehensive understanding of financial crime frameworks and the risks posed by global financial markets.

In-House Roles at Global Investment Banks

Adebayo has also held in-house compliance and audit positions at central investment banks. Within these roles, he served as:

- Financial Crime Internal Auditor

- Financial Crime Analyst

These roles allowed him to assess, test, and refine internal controls relating to:

- Anti-money laundering (AML)

- Sanctions

- Anti-bribery and corruption (ABC)

- Whistleblowing governance

- Market conduct and abuse prevention

His hands-on involvement in auditing and monitoring functions provided him with a deep understanding of how compliance risks materialize in real-world operations.

Regulatory Consulting at DWF Group

Today, Tunde Adebayo brings his diverse industry experience to DWF Group, where he plays an active role in helping clients meet regulatory expectations. His responsibilities include:

- Leading regulatory due diligence assignments

- Supporting large-scale remediation projects

- Advising on consumer duty and product governance

- Conducting compliance reviews for credit broking and payment services firms

- Delivering tailored regulatory training to organizations

Adebayo’s ability to work across multiple regulatory themes makes him a trusted advisor in a rapidly evolving compliance environment.

Areas of Expertise

The keyword “Tunde Adebayo” is strongly associated with core regulatory compliance domains. His recognized areas of expertise include:

Financial Crime Compliance (FCC)

Adebayo has in-depth knowledge of global financial crime frameworks, covering:

- AML and CTF requirements

- Sanctions screening

- Enhanced due diligence

- Transaction monitoring

- Anti-bribery and corruption controls

His ability to identify financial crime risks and evaluate internal control effectiveness is highly valued across financial institutions.

Risk Management

He is skilled in applying risk-based approaches to assess:

- Business models

- Operational processes

- Customer journeys

- Product risks

This skillset ensures that firms not only comply with regulations but also operate efficiently and responsibly.

Regulatory Governance

Adebayo regularly advises clients on:

- FCA requirements

- Consumer Duty obligations

- Conduct risk management

- Market abuse prevention

- Regulatory reporting standards

His guidance helps organizations build sustainable, compliant business frameworks.

Compliance Audits & Assurance

His internal audit background strengthens his ability to perform:

- Thematic reviews

- Process testing

- Control assessments

- Remediation evaluations

This combination of audit and consulting experience makes him particularly effective in diagnosing weaknesses and implementing corrective measures.

Professional Reputation and Approach

The professional reputation of Tunde Adebayo is shaped by his:

- Analytical thinking — A structured approach to problem-solving

- Attention to detail — Essential for high-risk environments

- Clear communication — Translating complex regulations into practical solutions

- Commitment to ethical business practices — A fundamental pillar of regulatory compliance

Colleagues and clients often highlight his ability to remain calm and objective when dealing with high-pressure regulatory challenges.

Why the Name Tunde Adebayo Matters in Compliance

As digital transformation accelerates within financial services, regulatory scrutiny continues to increase. Professionals like Tunde Adebayo play a vital role in helping organizations navigate this tightening landscape.

His work supports:

- Safer financial systems

- Better customer protection

- Stronger governance structures

- Improved industry standards

With expertise spanning multiple domains, Adebayo exemplifies the new generation of compliance leaders shaping the future of the financial services sector.

Conclusion

The name Tunde Adebayo has become associated with professionalism, regulatory insight, and a commitment to strengthening compliance cultures across financial institutions. Through his academic excellence, industry certifications, and diverse career experience, he has positioned himself as a respected voice in financial crime prevention and regulatory governance.

You May Also Read: Samuel Farage – An In-Depth Look at His Life, Career, and Business Ventures