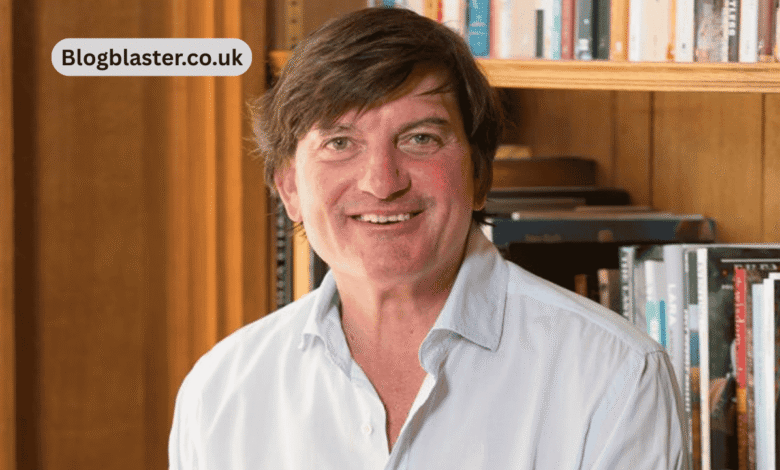

David Howden Net Worth: Inside the Fortune of the Insurance Tycoon

In the global insurance industry, one name that consistently stands out is David Howden. As the founder and CEO of Howden Group Holdings, he has built one of the world’s largest independent insurance brokerage groups. Naturally, many people are curious about David Howden net worth, how he accumulated his wealth, and what drives his financial success. In this comprehensive guide, we’ll explore David Howden’s estimated net worth, his career journey, the growth of Howden Group, his investments, lifestyle, and the factors that continue to influence his wealth.

Who Is David Howden?

David Howden is a British entrepreneur and insurance executive best known as the founder and CEO of Howden Group Holdings, a global insurance brokerage firm. He established the company in 1994 with a vision to create an independent brokerage that emphasized employee ownership and long-term growth.

Over the past three decades, Howden has transformed the company from a small startup into a global powerhouse operating in dozens of countries and employing thousands of professionals worldwide.

His leadership style, focus on strategic acquisitions, and commitment to employee ownership have made him one of the most respected figures in the insurance industry.

David Howden Net Worth in 2026

Estimated Net Worth: £700 Million+ (Approx. $850 Million+)

While exact figures are difficult to confirm due to the private nature of his company, most financial estimates suggest that David Howden net worth exceeds £700 million.

Because Howden Group Holdings is privately owned, his wealth is primarily tied to his equity stake in the company. The group has reportedly been valued at over £10 billion in recent internal and private market assessments. Even a modest ownership stake in a company of that size can translate into substantial personal wealth.

Why Estimates Vary

Unlike publicly traded CEOs whose wealth can be calculated based on stock prices, David Howden’s net worth is based on:

- Private company valuations

- Equity ownership percentage

- Long-term asset holdings

- Dividends and compensation

- Real estate and other investments

As a result, exact figures may fluctuate depending on market conditions and valuation methods.

How David Howden Built His Wealth

Understanding David Howden net worth requires examining how he built his fortune over time.

Founding Howden Group Holdings (1994)

David Howden founded Howden Group in London with a mission to create a people-first brokerage. Unlike many competitors, the company adopted a strong employee ownership model, aligning staff incentives with long-term company growth.

Starting as a small brokerage firm, the company focused on:

- Commercial insurance

- Risk management

- Specialty insurance markets

Over time, this approach fueled steady growth and expansion.

Strategic Global Expansion

One of the key drivers of David Howden’s net worth is the company’s aggressive yet strategic global expansion.

Howden Group expanded through:

- Acquisitions of regional insurance brokers

- Expansion into Europe, Asia, the Middle East, and the Americas

- Entry into reinsurance markets

- Growth in specialty insurance sectors

This expansion significantly increased the company’s valuation, boosting Howden’s personal wealth.

Major Acquisitions and Deals

Howden Group has completed numerous high-profile acquisitions over the years. Each acquisition strengthened the company’s global footprint and increased its revenue streams.

Strategic acquisitions have included:

- European brokerage firms

- Specialty risk advisors

- Reinsurance brokers

- Financial advisory firms

These deals played a major role in raising the firm’s valuation into the multi-billion-pound range.

Employee Ownership Model

One of the most unique aspects of David Howden’s business philosophy is his commitment to employee ownership.

A significant percentage of the company is owned by employees. This structure:

- Encourages long-term growth

- Reduces turnover

- Boosts company performance

- Increases overall valuation

By creating a culture of shared success, Howden built a sustainable growth model that increased both corporate value and his own net worth.

Breakdown of David Howden’s Wealth Sources

When analyzing David Howden’s net worth, it’s important to consider multiple sources of wealth.

Equity in Howden Group Holdings

The majority of his wealth comes from:

- Ownership stake in Howden Group

- Private equity growth

- Increasing company valuation

As the company’s value rises, so does the value of his shares.

Dividends and Executive Compensation

Although his salary may not be publicly disclosed, CEOs of companies of this scale typically receive:

- Executive salary

- Performance bonuses

- Dividends from equity ownership

However, his primary wealth driver remains equity rather than salary.

Investments and Assets

Like many high-net-worth individuals, David Howden likely diversifies his assets through:

- Real estate

- Private investments

- Financial portfolios

- Strategic business partnerships

Diversification helps preserve and grow long-term wealth.

Howden Group’s Role in His Net Worth Growth

The growth of Howden Group directly impacts David Howden net worth.

Revenue Growth

Howden Group has experienced significant revenue growth over the past decade. As revenues increased, so did the company’s valuation.

Private Equity Backing

At various stages, private equity firms have invested in Howden Group, further increasing its valuation. These investments typically come at high valuation multiples, benefiting shareholders.

Global Workforce Expansion

The company now employs thousands of professionals worldwide, making it one of the largest independent insurance brokers globally.

The scale and diversification of the business help insulate it from regional market downturns, contributing to sustained wealth growth.

Is David Howden a Billionaire?

A common question surrounding David Howden net worth is whether he is officially a billionaire.

Based on public estimates, he is close to or approaching billionaire status, depending on:

- Current company valuation

- Ownership percentage

- Market conditions

If the company’s valuation increases significantly or goes public in the future, his net worth could surpass the billion-pound mark.

Lifestyle and Philanthropy

Despite his substantial wealth, David Howden is known for maintaining a relatively low public profile compared to many high-net-worth entrepreneurs.

Philanthropic Interests

He has been associated with:

- Charitable initiatives

- Industry development programs

- Community-focused investments

Many successful business leaders in the UK financial sector actively support philanthropy and economic development.

Factors That Could Increase David Howden Net Worth

Several future developments could significantly boost his wealth:

IPO (Initial Public Offering)

If Howden Group were to go public, the transparency and liquidity event could dramatically increase the valuation and unlock additional wealth.

Further Acquisitions

Continued expansion and acquisitions in emerging markets could boost the company’s revenue and valuation.

Market Conditions

Favorable global insurance markets and strong economic growth can positively impact brokerage valuations.

Risks That Could Impact His Net Worth

Like any business leader, David Howden’s wealth is tied to market dynamics.

Potential risks include:

- Global economic downturns

- Insurance market volatility

- Regulatory changes

- Acquisition integration risks

However, the company’s diversification reduces overall exposure to these risks.

Comparison With Other Insurance Industry Leaders

Compared with other major insurance executives, David Howden ranks among the wealthiest independent brokerage founders in the UK.

Unlike executives who rely primarily on salary and bonuses, Howden’s wealth is equity-driven, which often results in higher long-term net worth accumulation.

Frequently Asked Questions (FAQs)

What is David Howden net worth in 2026?

David Howden’s estimated net worth exceeds £700 million, primarily tied to his ownership of Howden Group Holdings.

How did David Howden make his money?

He built his wealth by founding and growing Howden Group Holdings into a multi-billion-pound global insurance brokerage firm.

Is Howden Group publicly traded?

No, Howden Group Holdings is privately owned, which makes precise net worth calculations more complex.

Could David Howden become a billionaire?

Yes, if the company valuation increases significantly or the firm goes public, he could reach billionaire status.

Final Thoughts on David Howden Net Worth

The story of David Howden net worth is ultimately a story of long-term entrepreneurship, strategic growth, and equity ownership. From launching a small brokerage in 1994 to building a global insurance powerhouse valued at over £10 billion, his journey reflects decades of calculated expansion and leadership.

You May Also Read: Damian Schnabel: Career, Personal Life, and Legacy