Error Code FintechAsia: Meaning, Causes, and Step-by-Step Solutions

In today’s rapidly growing digital finance ecosystem, platforms that combine banking, payments, and financial technology must handle millions of transactions in real time. When something goes wrong, users are often shown a system message commonly referred to as an error code fintechasia. For many users, this message can feel confusing or even alarming—especially when money or account access is involved. This article provides a complete, in-depth guide to understanding error code fintechasia, why it appears, the most common causes, and how to fix or prevent it. Whether you are an everyday user, a business owner, or a developer working with fintech systems, this guide will help you navigate the issue confidently.

Understanding What Error Code FintechAsia Means

The error code fintechasia does not usually refer to a single universal error. Instead, it is a broad label used by platforms, services, or applications associated with Fintech Asia–related systems to indicate that an error has occurred during a financial or technical operation.

An error code exists to communicate:

- What type of issue occurred

- Where the issue happened (login, payment, API, verification)

- What action should be taken next

Rather than being random, each error code fintechasia message is designed to help users or developers diagnose problems faster.

Why Error Code FintechAsia Appears

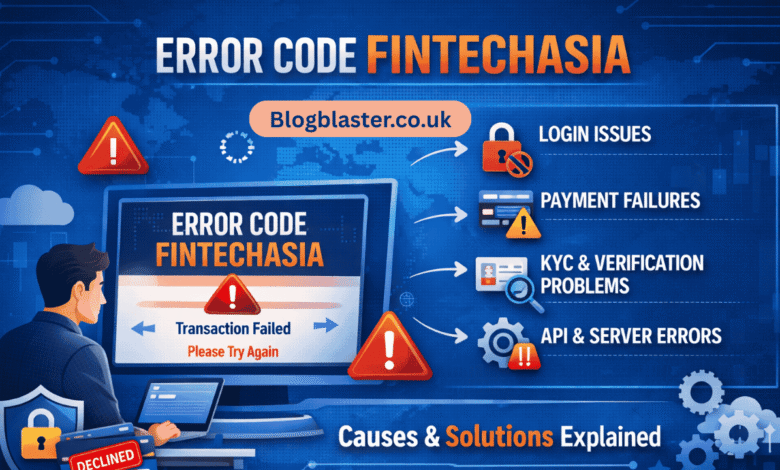

There are several reasons why an error code fintechasia may appear on your screen. These causes generally fall into technical, security, or user-related categories.

Common Reasons Include:

- Failed authentication attempts

- Payment gateway interruptions

- Incomplete user verification (KYC issues)

- API request failures

- Server overload or downtime

- Invalid or missing transaction data

Understanding the problem’s category is the first step toward resolving it.

Common Types of Error Code FintechAsia

Although exact codes vary by platform, most error code fintechasia messages fall into predictable groups. Below are the most common categories you may encounter.

Authentication and Login Errors

These errors occur when the system cannot verify your identity.

Typical causes:

- Incorrect username or password

- Expired login session

- Invalid or revoked API keys

- Two-factor authentication failure

These are among the most frequent error code fintechasia messages and are usually resolved quickly with credential verification.

Payment and Transaction Errors

Payment-related error code fintechasia messages can be stressful because they often involve money movement.

Common triggers:

- Insufficient balance

- Invalid payment method

- Transaction timeouts

- Currency or regional restrictions

- Bank or gateway rejection

In many cases, the transaction fails safely, and no money is deducted.

Verification and Compliance Errors

Financial platforms must comply with strict regulations. An error code fintechasia related to compliance usually means your account does not meet verification requirements.

Examples include:

- Missing identity documents

- Unverified phone number or email

- Mismatched personal information

- Pending KYC approval

These errors protect both the platform and the user from fraud.

API and Integration Errors

Developers often encounter error code fintechasia messages when integrating fintech services into apps or websites.

Typical causes:

- Incorrect API endpoints

- Invalid request format

- Missing required parameters

- Rate-limit violations

These errors are common during development and testing phases.

Server and System Errors

Sometimes the problem is not on your side. Server-level error code fintechasia messages appear when systems are overloaded or undergoing maintenance.

Examples:

- Internal server errors

- Temporary service outages

- Scheduled maintenance windows

- Network connectivity failures

These issues are usually resolved by the platform itself.

How to Fix Error Code FintechAsia: Step-by-Step

While the exact solution depends on the specific code, the steps below resolve most fintechasia error codes.

Read the Error Message Carefully

Many users skip this step. The message often includes clues such as “authentication failed” or “transaction declined.”

Refresh or Retry the Action

Temporary glitches can trigger error code fintechasia alerts. A refresh or retry often works.

Check Credentials and Input Data

Verify:

- Login details

- Payment information

- API keys

- Required form fields

Incorrect or missing data is a top cause of errors.

Confirm Account Verification Status

Ensure your identity verification, email, and phone number are fully approved.

Check Platform Status

Sometimes the platform is experiencing downtime. Waiting a few minutes may resolve the error automatically.

Step 6: Contact Support

If the error code fintechasia persists, contact the platform’s support team and provide:

- The exact error code

- Time and date of occurrence

- Screenshots if possible

How Developers Can Prevent Error Code FintechAsia

For developers and businesses, preventing errors improves user trust and system stability.

Best Practices Include:

- Validating all user input before submission

- Implementing retry logic for failed requests

- Monitoring API rate limits

- Logging error code fintechasia responses

- Keeping API credentials secure and updated

Proactive monitoring significantly reduces the impact of errors.

Is Error Code FintechAsia Dangerous?

In most cases, error code fintechasia is not dangerous. It is a protective system response designed to prevent incorrect transactions, unauthorized access, or data corruption.

However, repeated errors may indicate:

- A compromised account

- Misconfigured integrations

- Outdated app versions

Addressing errors promptly ensures both security and usability.

Best Practices to Avoid Error Code FintechAsia in the Future

You have the ability to diminish the likelihood of experiencing an error code fintechasia by following these best practices:

- Keep your app or browser updated

- Use strong, unique passwords

- Complete verification processes fully

- Avoid rapid repeated transactions

- Monitor system notifications and alerts

Consistency and caution go a long way in fintech systems.

Conclusion: Final Thoughts on Error Code FintechAsia

The error code fintechasia message may seem intimidating at first, but it serves an important purpose. It protects users, ensures regulatory compliance, and maintains the integrity of financial systems. Rather than being a sign of failure, it is a communication tool that helps identify and resolve issues efficiently.

You May Also Read: Trbie HR Team: A Warning on the Rising Recruitment Scam Trend